working capital funding gap in days

According to a recent working capital practices study of the manufacturing and distribution industry 161 percent of accounts receivable are still in the bush 180 days after. Whats the companys working capital funding gap in days based on the information below.

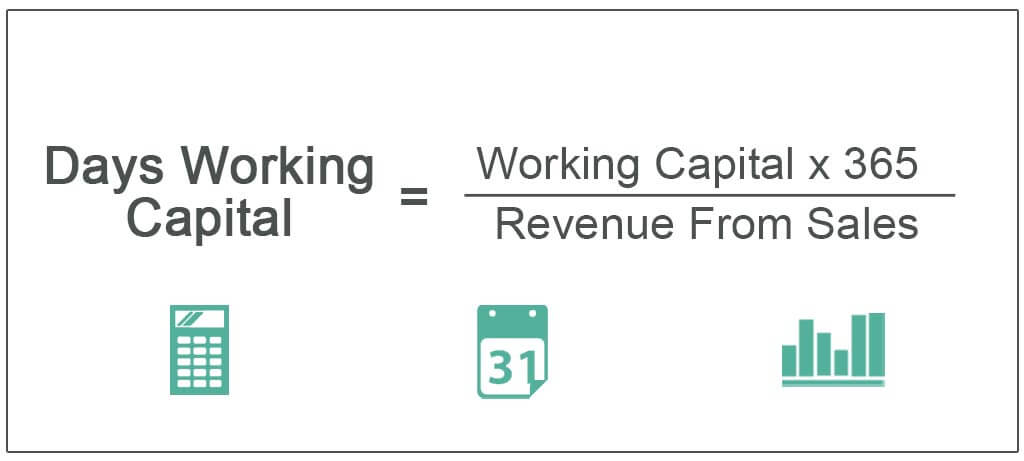

Days Working Capital Definition Formula How To Calculate

Calculation of Days Working Capital.

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

. The days working capital is calculated by 200000 or working capital x 365 10000000. Net Working Capital 80000. For example they have 90 days to pay for the raw materials payable days.

The company sells its inven. For most companies the working capital cycle works as follows. 456 Days in the period.

472 Inventory days. If the company borrowed money at 7 it paid 442288 in interest for each day in its cash gap. 365 413 361 583 329 Based on the information below how much does the company need to finance.

Days working capital 73 days. Working Capital Days Receivable Days Inventory Days Payable Days. A longer working capital cycle means money is tied up in current liabilities and current assets for longer.

Why you should use us for First. If however the business chooses to use long term finance this flexibility is. The Cash Conversion Cycle CCC of the SP.

In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities. Here in the above. Even if the terms are.

If the poor collection procedures. It can also be described. 90k invested x 90 81k 171k paid back.

Average working capital performance parameters across the SP 1500 companies 20122020 in average number of days Source. Since cost of sales was 718 it had to finance 6318000 for each day of its cash gap. Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625.

90 days 90 20k invested x 90 18k 38k paid back. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank. Days in the period.

The company purchases on credit materials to manufacture a product. 40k invested x 90 36k 76k paid back. Calculation of Net Working Capital.

345 Payable days. For example if you pay suppliers in 30 days but it takes you 90 days to collect. However if the company made 12 million in.

This ratio measures how efficiently a company is able to convert its working capital into revenue. By substituting 90 days instead of 45 days in the formula used above the working capital requirement doubles to 45000 or 247 of revenue. Working Capital Gap.

For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap to fill with some form of working capital financing.

Types Of Working Capital Gross Net Temporary Permanent Efm

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital Cycle Definition How To Calculate

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital What Is Working Capital Youtube

Working Capital Formula Youtube

Working Capital Cycle Understanding The Working Capital Cycle